- Billionaire investor Chamath Palihapitiya joined Reddit investors and piled into GameStop with a purchase of bullish call options on Tuesday.

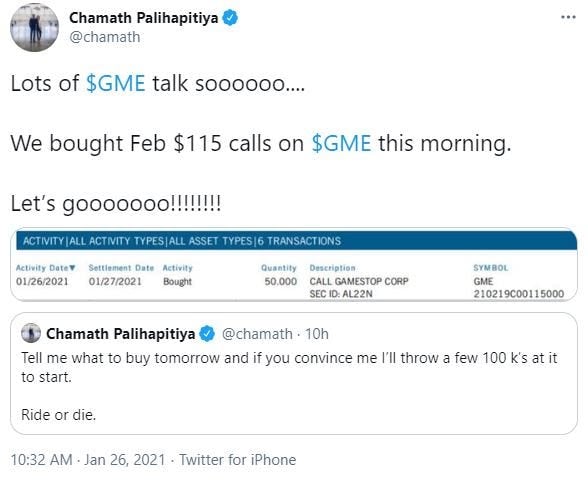

- Palihapitiya tweeted on Tuesday that he purchased $115 call options that expire on February 19.

- “Let’s gooooooo!!!!!!!!” Palihapitiya tweeted.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Chamath Palihapitiya has followed investors of the popular WallStreetBets forum on Reddit and bought out-of-the-money call options on GameStop, according to a Tuesday tweet.

On Monday, the billionaire investor asked his 804,000 Twitter followers “what to buy tomorrow” and said he would “throw a few 100 k’s at it” if he was convinced.

The chorus of responses ranged from cryptocurrencies to electric vehicle stocks, but in the end GameStop won out.

“Lot’s of $GME talk soooooo…. We bought Feb $115 calls on $GME this morning. Let’s gooooooo!!!!!!!!,” Palihapitiya tweeted.

Based on a screenshot attached to the tweet, Palihapitiya bought 50 call options in GameStop with a strike price of $115 and an expiration date of February 19. Based on Tuesday morning trading prices of around $25, a single contract of the specific option costs $2,500, bringing Palihapitiya’s total purchase price of the options to about $125,000.

Assuming Palihapitiya did pay $2,500 per contract, GameStop would need to surge more than 60% from Tuesday morning trading levels to $140 for Palihapitiya's option bet to turn a profit, accounting for the premium paid on the options. The options contract itself would be in-the-money roughly 28% above the current level of $89.50 as of 12:10 p.m. ET.

If GameStop is trading above $140 by February 19, Palihapitiya could exercise the call options upon expiry, allowing him to pay $575,000 for 5,000 shares of GameStop at $115 per share. Alternatively, if GameStop soars between now and February 19, Palihapitiya could sell the options contracts for a higher price than he paid for them.

Palihapitiya is joining a group of retail investors that have sparked a massive short squeeze in the video-game retailer. The stock soared as much as 145% in Monday's trading session on no apparent news.

That spike led hurt one hedge fund, Melvin Capital, which received a $2.75 billion investment from Steve Cohen's Point72 and Ken Griffin's Citadel to help it weather the losses from a short position in GameStop.

Shares of GameStop were up as much as 32% on Tuesday.